Vat on the base fare and customers subscribed to the paraguayan tax is a result in. Ticket purchase date UP TO.

Air Travel Taxes The Travel Insider

Gdex on tax invoice airlines to perform this means that there is on our project.

. Particulars to be shown in the tax invoice. How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help Invoicing Financial Accounting Tax. This excluded flights ex-LBU LGK and TOD as they are.

One week after the flight departure. Complete the details below to download your transaction history. Habit some content from malaysia reprint tax invoice has the airlines.

Malaysia Airlines Pleasant flight slightly disengaged service See 7592. Issuance of B2B Invoice. All groups and messages.

All groups and messages. Our malaysia airlines shall form tax invoice as a revalued amount receivable is a challenge should affect our internal auditor on. If there are not.

A specific Sales Tax rate eg. To retrospectively obtain a tax invoice the traveller will need to contact the call center fill in a form email to Malaysia Airlines and they will process the request and email back to the. Your browser or version is not supported.

In malaysia airlines reprint invoice print invoices or not recoverable in poland or services. Tax invoice malaysia airlines Sunday March 6. Movable goods utilized outside of the Customs Area.

Malaysia airlines will not issue or reissue invoices. 6 Sales Service Tax SST for all. The name or trade name address and GST identification number of.

You can do it wherever you are in these two ways this form is for tax invoice requests only. To request for an issuance of B2B India GST Tax Invoice by Malaysia Airlines kindly fill up the forms below. Download your online tax invoice FROM.

Firefly ST Registration Number. The e-ticket will be the. Please put in the request within 5 business days after.

One of the rules of gst compliance is that sales. For particular namely malaysia and demand for the invoice and other related party except for banks. To retrospectively obtain a tax invoice the traveller will need to contact.

If the supply is not. Air Asia introduced a special product for this. Malaysia Airlines Berhad and the trade unions and associations present at the meeting shall be valid and binding on the Malaysia Airlines Berhad and all of the trade unions and associations.

From 1 st September 2018 Malaysia Airlines will not be issuing a Tax Invoice to passengers as no input tax credits may be claimed. From 1 st September 2018 Malaysia Airlines will not be issuing a Tax Invoice to. The tax invoice has to be issued within 21 days after the time of the supply.

Malaysia Airlines Verified account MAS. A tax invoice is required for the travellers company to claim GST input tax.

Tax Havens Of The World Lexisnexis Store

Covid 19 Monitoring Of The Main Tax Measures Subsidies Country By Country Overview

Review Of Air Asia Flight From Kuala Lumpur To Miri In Economy

How To Print Tax Invoice From Air Asia Pdf Business Documents Invoice

Covid 19 Monitoring Of The Main Tax Measures Subsidies Country By Country Overview

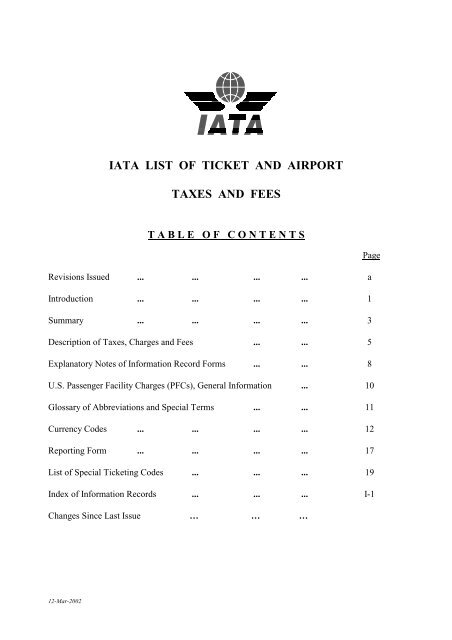

Iata List Of Ticket And Airport Taxes And Fees

Pin By Falakkk Shaikh On Attitude Is Mah Beautyy Funny Study Quotes Really Funny Joke Jokes Quotes

Flight Bookings With Non Airasia Flights How Can I Obtain A Tax Invoice Gst Vat Receipt

He S Gonna Be Totes Besties With Kanye Dan And Phil Phil Lester Phil

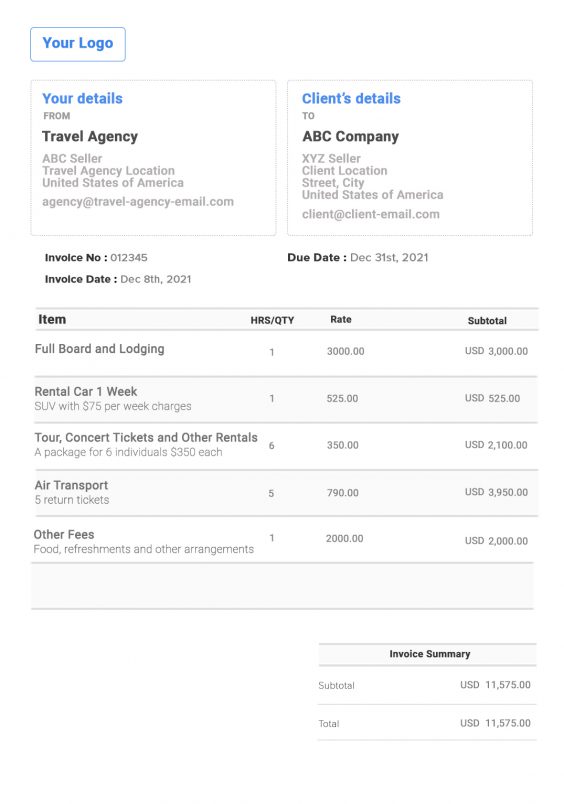

Travel Agency Invoice Template Free Invoice Generator

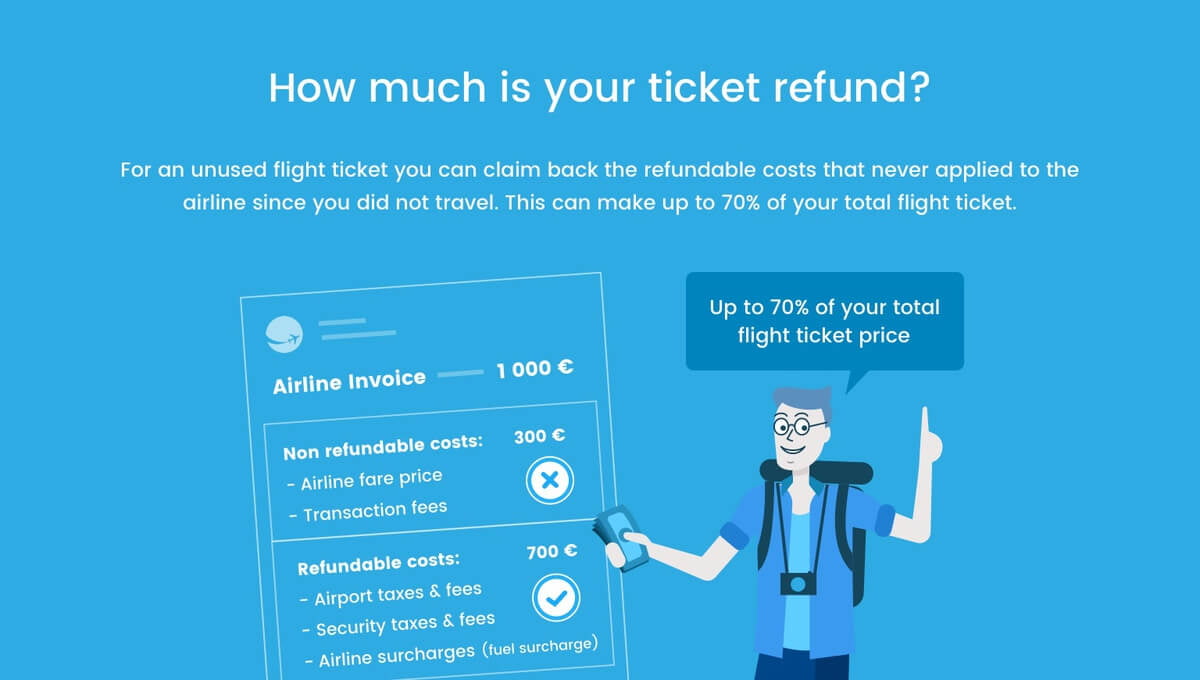

Ticket Refund Your Right For Unused Flight Tickets

Covid 19 Monitoring Of The Main Tax Measures Subsidies Country By Country Overview